Understanding Auto and Renters Insurance Bundle Savings

Bundling auto and renters insurance combines your vehicle coverage and apartment or rental home protection under a single insurance provider, delivering substantial savings, simplified management, and enhanced coverage options. This comprehensive guide explores how insurance bundling works, potential savings, top providers, and strategies to maximize your bundle benefits.

What Is Auto and Renters Insurance Bundling?

An auto and renters insurance bundle packages your car insurance and renters insurance policies with the same insurance company. Instead of managing separate policies from different providers, bundling consolidates your coverage, typically offering multi-policy discounts ranging from 5% to 25% on both policies.

Key Benefits of Bundling Insurance Policies

Cost Savings: Most insurance companies offer significant multi-policy discounts, with average savings of $300-$600 annually when combining auto and renters coverage.

Simplified Management: One insurance company, one payment, one renewal date, and one customer service contact for all your coverage needs.

Enhanced Coverage Options: Bundled policies often include additional perks like higher coverage limits, accident forgiveness, and loyalty rewards not available to single-policy holders.

Streamlined Claims Process: Filing claims becomes easier when both policies are with the same insurer, especially for incidents affecting multiple coverage types.

Key Benefits of Bundling Insurance Policies

Cost Savings: Most insurance companies offer significant multi-policy discounts, with average savings of $300-$600 annually when combining auto and renters coverage.

Cost Savings: Most insurance companies offer significant multi-policy discounts, with average savings of $300-$600 annually when combining auto and renters coverage.

Simplified Management: One insurance company, one payment, one renewal date, and one customer service contact for all your coverage needs.

Enhanced Coverage Options: Bundled policies often include additional perks like higher coverage limits, accident forgiveness, and loyalty rewards not available to single-policy holders.

Streamlined Claims Process: Filing claims becomes easier when both policies are with the same insurer, especially for incidents affecting multiple coverage types.

Average Auto and Renters Bundle Costs

| Coverage Combination | Standalone Cost | Bundled Cost | Annual Savings | Discount Percentage |

|---|---|---|---|---|

| Full Auto + Basic Renters | $1,800 + $180 | $1,683 | $297 | 15% |

| Full Auto + Standard Renters | $1,800 + $250 | $1,743 | $307 | 15% |

| Minimum Auto + Basic Renters | $800 + $180 | $833 | $147 | 15% |

| Full Auto + Premium Renters | $1,800 + $350 | $1,828 | $322 | 15% |

| Two Cars + Standard Renters | $2,400 + $250 | $2,253 | $397 | 15% |

| Luxury Auto + High-Value Renters | $2,500 + $450 | $2,508 | $442 | 15% |

Average bundle savings: 10-25% depending on provider, location, and coverage levels

Top Insurance Companies for Auto and Renters Bundle 2025

Comprehensive Provider Comparison

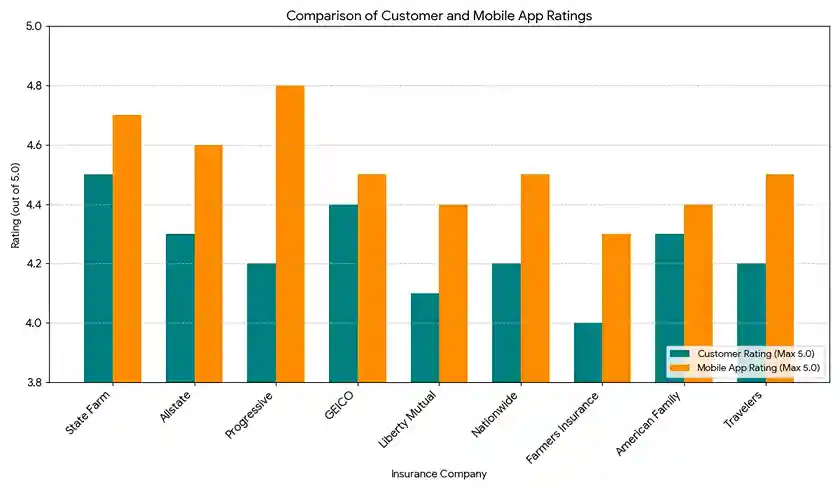

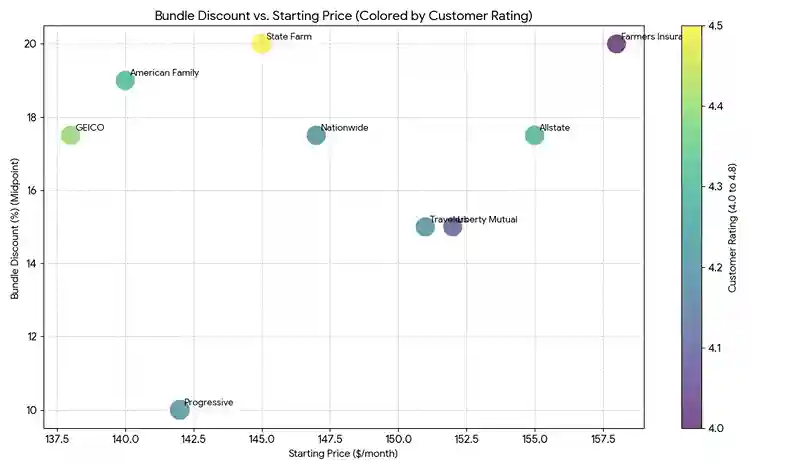

| Insurance Company | Bundle Discount | Customer Rating | Best For | Starting Price | Mobile App Rating |

|---|---|---|---|---|---|

| State Farm | 15-25% | 4.5/5 | Overall value and service | $145/month | 4.7/5 |

| Allstate | 10-25% | 4.3/5 | Comprehensive coverage options | $155/month | 4.6/5 |

| Progressive | 5-15% | 4.2/5 | Tech-savvy users, Name Your Price | $142/month | 4.8/5 |

| GEICO | 15-20% | 4.4/5 | Budget-conscious renters | $138/month | 4.5/5 |

| Liberty Mutual | 10-20% | 4.1/5 | Customizable coverage | $152/month | 4.4/5 |

| Nationwide | 15-20% | 4.2/5 | Small apartment dwellers | $147/month | 4.5/5 |

| Farmers Insurance | 15-25% | 4.0/5 | High-value possessions | $158/month | 4.3/5 |

| American Family | 15-23% | 4.3/5 | Midwest residents | $140/month | 4.4/5 |

| Travelers | 10-20% | 4.2/5 | Professional renters | $151/month | 4.5/5 |

| USAA | 10-25% | 4.8/5 | Military families (members only) | $132/month | 4.9/5 |

Detailed Reviews: Best Auto and Renters Insurance

1. State Farm Bundle Review ⭐⭐⭐⭐⭐

Overall Rating: 4.5/5

State Farm Bundle Review

Pros

- Largest agent network with over 19,000 locations

- Exceptional personalized service

- Drive Safe & Save program (up to 30%)

- Stacking Discounts (bundle + safe driver + good student)

- Accident forgiveness after 3 years claim-free

Cons

- Higher prices in urban markets

- Some features require agent assistance

- Limited online customization

Best For:

Renters who value personal agent relationships and comprehensive local support.

Renters Coverage Highlights:

Personal property coverage up to $100,000, liability protection, loss of use coverage, medical payments to others.

Auto Coverage Highlights:

Comprehensive liability, collision, uninsured motorist, rental reimbursement, rideshare coverage available.

– Sarah M., Chicago, IL

2. Allstate Bundle Review ⭐⭐⭐⭐☆

Overall Rating: 4.3/5

Allstate Bundle Review

Pros

- Drivewise program provides up to 40% savings for safe driving habits

- Claim satisfaction guarantee with hassle-free claims process

- New car replacement coverage available for vehicles under 2 years

- Extensive coverage customization options

- Identity theft restoration services included

- Accident forgiveness after 5 years without claims

Cons

- Higher premiums in some metropolitan areas

- Bundle discounts vary significantly by state

- Deductible rewards require extended claim-free periods

Best For:

Tech-forward renters seeking comprehensive digital tools and customizable coverage.

Renters Coverage Highlights:

Replacement cost coverage available, valuable items coverage up to $10,000, identity theft protection, automatic coverage increases.

Auto Coverage Highlights:

Sound system coverage, pet injury coverage, custom parts coverage, safe driving bonus checks.

– Michael T., Austin, TX

3. Progressive Bundle Review ⭐⭐⭐⭐☆

Overall Rating: 4.2/5

Progressive Bundle Review

Pros

- Name Your Price tool helps customize coverage to your budget

- Snapshot program offers personalized rates based on driving behavior

- Superior mobile app with instant policy management

- Pet injury coverage included automatically

- 24/7 claims service with quick response times

- Home/Renters Comparison tool shows savings opportunities

Cons

- Bundle discounts lower than some competitors

- Renters insurance add-ons can increase costs significantly

- Limited local agent availability in rural areas

Best For:

Budget-conscious tech users wanting transparent pricing and a digital-first experience.

Renters Coverage Highlights:

Water backup coverage, earthquake coverage available, replacement cost option, automatic inflation protection.

Auto Coverage Highlights:

Ride-sharing coverage, gap insurance, custom equipment coverage, roadside assistance.

– Jennifer L., Denver, CO

4. GEICO Bundle Review ⭐⭐⭐⭐☆

Overall Rating: 4.4/5

GEICO Bundle Review

Pros

- Consistently competitive pricing across most states

- Easy 15-minute online quote process

- Military and federal employee discounts available

- Mechanical breakdown insurance available for newer vehicles

- Emergency roadside assistance included with most policies

- Flexible payment plans with no installment fees

Cons

- Fewer customization options compared to larger carriers

- Renters insurance underwritten by third-party providers

- Limited local agent presence for in-person service

Best For:

Price-sensitive renters seeking straightforward, affordable coverage with minimal frills.

Renters Coverage Highlights:

Personal property coverage, liability protection, medical payments, loss assessment coverage for condo associations.

Auto Coverage Highlights:

Comprehensive collision coverage, rental reimbursement, emergency roadside service, rideshare insurance.

– David K., Miami, FL

5. Liberty Mutual Bundle Review ⭐⭐⭐⭐☆

Overall Rating: 4.1/5

Liberty Mutual Bundle Review

Pros

- Better Car Replacement pays 25% more than actual cash value

- RightTrack program saves up to 30% for safe driving

- New car replacement for vehicles less than one year old

- Accident forgiveness available after qualifying period

- Flexible coverage options with extensive customization

- Deductible fund rewards claim-free customers

Cons

- Pricing can be higher without stacked discounts

- Complaint ratio slightly above industry average in some states

- Mobile app features lag behind competitors

Best For:

Renters with newer vehicles seeking enhanced replacement coverage and customization flexibility.

Renters Coverage Highlights:

Replacement cost coverage, valuable possessions protection up to $20,000, identity fraud expense coverage, water backup protection.

Auto Coverage Highlights:

Better car replacement, original equipment manufacturer (OEM) parts guarantee, gap coverage available, roadside assistance.

– Amanda R., Seattle, WA

6. Nationwide Bundle Review ⭐⭐⭐⭐☆

Overall Rating: 4.2/5

Nationwide Bundle Review ⭐⭐⭐⭐☆

Pros

- SmartRide program offers personalized discounts up to 40%

- Vanishing deductible reduces by $100 annually for safe driving

- Brand New Belongings coverage replaces items without depreciation

- On Your Side Review provides annual coverage optimization

- Pet insurance bundle available for additional savings

- Accident forgiveness for long-term customers

Cons

- Geographic availability limitations in some states

- Higher premiums in metropolitan markets

- Some advanced features require agent consultation

Best For:

Small apartment renters seeking comprehensive personal property protection with depreciation-free coverage.

Renters Coverage Highlights:

Brand New Belongings replacement, water damage coverage, identity theft protection, extended replacement cost.

Auto Coverage Highlights:

Comprehensive liability, collision coverage, uninsured motorist protection, rental reimbursement, minor violation forgiveness.

– Robert H., Portland, OR

7. Farmers Insurance Bundle Review ⭐⭐⭐⭐☆

Overall Rating: 4.0/5

Farmers Bundle Review ⭐⭐⭐⭐☆

Pros

- Signal app provides personalized discounts based on safe driving

- Claim forgiveness after 3 years without incidents

- Scheduled personal property coverage for high-value items

- Identity Shield protection included with renters policies

- New vehicle discounts for cars less than 3 years old

- Flexible deductible options from $0–$2,500

Cons

- Premium costs higher than some national competitors

- Customer satisfaction ratings vary by region

- Limited digital self-service compared to tech-focused insurers

Best For:

Renters with high-value possessions (jewelry, art, electronics) requiring scheduled item coverage.

Renters Coverage Highlights:

Replacement cost on contents, scheduled personal property coverage up to $50,000, water backup coverage, identity theft protection.

Auto Coverage Highlights:

Comprehensive coverage, collision protection, rideshare coverage available, roadside assistance, rental car reimbursement.

– Lisa W., San Francisco, CA

8. USAA Bundle Review ⭐⭐⭐⭐⭐

Overall Rating: 4.8/5 (Military Members Only)

USAA Bundle Review ⭐⭐⭐⭐⭐

Pros

- Consistently lowest rates for military families

- Exceptional customer service ranked #1 in satisfaction

- Deployment discounts for active-duty service members

- Stored vehicle coverage for deployed personnel

- Comprehensive coverage with minimal exclusions

- Superior mobile app with all-digital management

- No restrictions on vehicle storage locations worldwide

Cons

- Membership restricted to military members and families

- Geographic limitations for local agent services

- Must qualify through military service or family connection

Best For:

Military service members, veterans, and their families seeking premium coverage at exceptional value.

Renters Coverage Highlights:

Personal property coverage worldwide, military gear protection, deployment accommodations, comprehensive liability protection.

Auto Coverage Highlights:

Worldwide coverage, military installation discounts, deployment suspension options, rental car coverage during repairs.

– Captain James M., Norfolk, VA

Auto and Renters Insurance Coverage Details

What Auto Insurance Typically Includes

| Coverage Type | Description | Typical Limits | Importance |

|---|---|---|---|

| Liability Coverage | Bodily injury and property damage to others | $50,000-$500,000 | Legally required in most states |

| Collision Coverage | Damage to your vehicle from accidents | Actual cash value | Essential for financed vehicles |

| Comprehensive Coverage | Non-collision damage (theft, weather, vandalism) | Actual cash value | Protects against unpredictable losses |

| Uninsured Motorist | Coverage when at-fault driver lacks insurance | $25,000-$250,000 | Critical in states with high uninsured rates |

| Personal Injury Protection | Medical expenses regardless of fault | $2,500-$250,000 | Required in no-fault states |

| Medical Payments | Healthcare costs after accidents | $1,000-$10,000 | Supplements health insurance |

What Renters Insurance Typically Includes

| Coverage Type | Description | Typical Limits | Importance |

|---|---|---|---|

| Personal Property | Belongings damaged by covered perils | $10,000-$100,000 | Replaces or repairs your possessions |

| Liability Protection | Legal defense and damages if sued | $100,000-$500,000 | Protects against lawsuits |

| Additional Living Expenses | Housing costs if apartment uninhabitable | 20-30% of personal property limit | Covers temporary relocation |

| Medical Payments to Others | Guest injuries in your rental | $1,000-$5,000 | Pays regardless of fault |

| Personal Property Off-Premises | Items stolen from car or other locations | 10% of personal property limit | Extends coverage beyond apartment |

Bundle Discount Breakdown by Provider

| Insurance Company | Auto Discount | Renters Discount | Combined Savings | Additional Stackable Discounts |

|---|---|---|---|---|

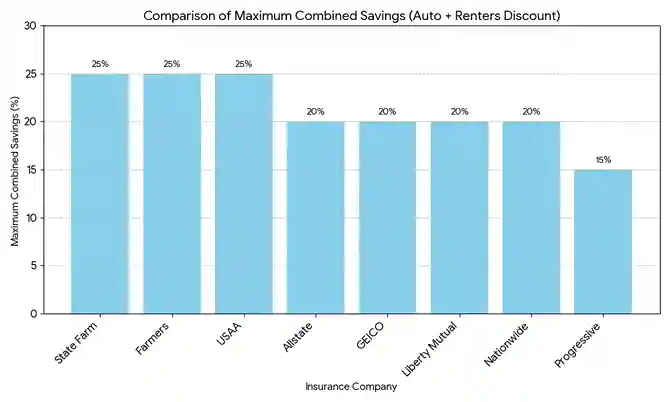

| State Farm | 10-15% | 10-20% | Up to 25% total | Safe driver, good student, multi-car |

| Allstate | 10-20% | 10-15% | Up to 25% total | Drivewise, paid-in-full, anti-theft |

| Progressive | 5-10% | 5-10% | Up to 15% total | Snapshot, homeowner, continuous coverage |

| GEICO | 10-15% | 10-15% | Up to 20% total | Military, federal employee, anti-theft |

| Liberty Mutual | 10-15% | 5-15% | Up to 20% total | RightTrack, multi-car, pay-in-full |

| Nationwide | 10-15% | 10-15% | Up to 20% total | SmartRide, vanishing deductible, multi-policy |

| Farmers | 10-20% | 10-15% | Up to 25% total | Signal app, claim-free, security system |

| USAA | 10-15% | 10-15% | Up to 25% total | Military, safe driver, loyalty |

How Much Can You Save with Auto and Renters Bundle?

Average Savings Calculator

Scenario 1: Young Professional (25–35 years old)

Standalone auto insurance: $1,500/year

Standalone renters insurance: $200/year

Bundled total: $1,445/year

Annual savings: $255 (15% discount)

Scenario 2: Family with Multiple Vehicles

Standalone auto insurance (2 cars): $2,400/year

Standalone renters insurance: $300/year

Bundled total: $2,295/year

Annual savings: $405 (15% discount)

Scenario 3: Urban Renter with Older Vehicle

Standalone auto insurance: $900/year

Standalone renters insurance: $180/year

Bundled total: $918/year

Annual savings: $162 (15% discount)

Scenario 4: High-Value Property Owner

Standalone auto insurance: $2,000/year

Standalone renters insurance (high coverage): $450/year

Bundled total: $2,083/year

Annual savings: $367 (15% discount)

Factors Affecting Your Bundle Insurance Rates (Auto and Renters Insurance Bundle)

| Factor | Impact on Auto Premium | Impact on Renters Premium | Optimization Strategy |

|---|---|---|---|

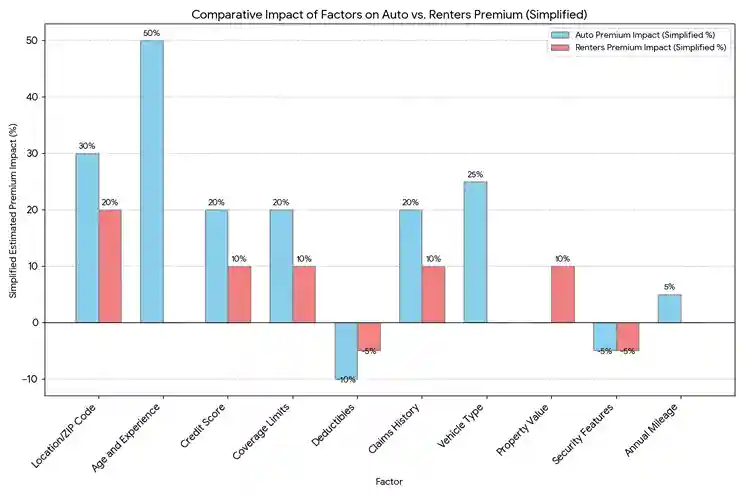

| Location/ZIP Code | 30-50% variation | 20-40% variation | Verify accurate address, consider security |

| Age and Experience | Drivers under 25 pay 50-100% more | Minimal impact | Add experienced drivers, take safety courses |

| Credit Score | 20-50% impact in most states | 10-30% impact | Improve credit over time |

| Coverage Limits | Higher limits = Higher premium | Higher limits = Higher premium | Balance adequate protection with budget |

| Deductibles | Higher deductible = Lower premium | Higher deductible = Lower premium | Choose $500-$1,000 sweet spot |

| Claims History | Each claim increases rates 20-40% | Claims increase rates 10-30% | Maintain 3-5 year claim-free record |

| Vehicle Type | Sports cars = 25-100% higher | No impact | Choose insurance-friendly vehicles |

| Property Value | No impact | Higher value = Higher premium | Accurate inventory prevents over/under insuring |

| Security Features | Alarm/anti-theft = 5-15% discount | Building security = 5-20% discount | Install approved devices |

| Annual Mileage | Higher mileage = Higher rates | No impact | Consider usage-based insurance |

Additional Discounts to Stack with Your Bundle (Auto and Renters Insurance Bundle)

Auto Insurance Additional Discounts

| Discount Type | Average Savings | Eligibility | Stackable with Bundle? |

|---|---|---|---|

| Safe Driver Discount | 10-25% | 3-5 years claim-free | Yes ✓ |

| Good Student Discount | 10-25% | Students with 3.0+ GPA | Yes ✓ |

| Defensive Driving Course | 5-15% | Complete approved course | Yes ✓ |

| Low Mileage Discount | 5-15% | Under 7,500 miles annually | Yes ✓ |

| Anti-Theft Devices | 5-15% | GPS, alarm, immobilizer installed | Yes ✓ |

| Pay-in-Full Discount | 5-10% | Annual premium payment | Yes ✓ |

| Paperless/Auto-Pay | 2-5% | Electronic documents and payments | Yes ✓ |

| Multi-Car Discount | 10-25% | Insure 2+ vehicles | Yes ✓ |

| Loyalty Discount | 5-15% | 3+ years with same insurer | Yes ✓ |

| Telematics/Usage-Based | 10-40% | Safe driving monitoring | Yes ✓ |

Renters Insurance Additional Discounts

| Discount Type | Average Savings | Eligibility | Stackable with Bundle? |

|---|---|---|---|

| Security System Discount | 5-20% | Monitored alarm, deadbolts | Yes ✓ |

| Claims-Free Discount | 5-15% | No claims for 3-5 years | Yes ✓ |

| Gated Community Discount | 5-10% | Living in secured complex | Yes ✓ |

| Smoke Detector/Sprinkler | 5-10% | Fire safety systems installed | Yes ✓ |

| Senior Discount | 5-10% | Age 55+ | Yes ✓ |

| Loyalty Discount | 5-10% | Long-term customer | Yes ✓ |

| Paid-in-Full Discount | 3-7% | Annual payment | Yes ✓ |

| Association Member Discount | 5-10% | Alumni, professional groups | Yes ✓ |

| New Customer Discount | 5-15% | Switching to new provider | Temporary |

When Bundling May NOT Be Your Best Option (Auto and Renters Insurance Bundle)

Consider Separate Policies If:

You Find Lower Individual Rates: Sometimes separate specialized insurers offer better rates even without bundle discounts. Always compare total costs.

Your Auto Insurance Is High-Risk: If accidents or violations make your auto insurance expensive, bundling may increase renters insurance costs unnecessarily.

You Need Specialized Coverage: Niche insurers sometimes provide better coverage for unique situations (classic cars, high-value collections) than bundle-focused companies.

You’re Switching Insurers Mid-Term: Early cancellation fees may negate bundle savings. Wait until renewal to optimize bundling benefits.

Limited Bundle Discounts Available: Some insurers offer minimal bundle savings (under 5%), making shopping individually more cost-effective.

How to Get the Best Auto and Renters Insurance Bundle Quote

Step 1: Inventory Your Coverage Needs

Auto Insurance Requirements:

- Determine state minimum liability requirements

- Assess vehicle value for comprehensive/collision decisions

- Calculate appropriate deductible levels

- Consider additional coverage (rental, roadside, gap insurance)

Renters Insurance Requirements:

- Create home inventory with estimated replacement values

- Determine necessary liability protection levels

- Assess need for scheduled item coverage (jewelry, electronics)

- Calculate additional living expenses coverage needed

Step 2: Compare At Least 5 Bundle Quotes

Contact multiple insurers to compare:

- Total bundled premium costs

- Available discount percentages

- Coverage limits and exclusions

- Deductible options

- Additional features and benefits

- Customer service ratings

- Claims satisfaction scores

Step 3: Ask About Available Discounts

Inquire specifically about:

- Multi-policy bundle discounts

- Loyalty or tenure discounts

- Professional association memberships

- Safety feature discounts

- Payment method discounts (auto-pay, paperless)

- Security system or device discounts

Step 4: Review Policy Details Carefully

Verify:

- Coverage limits match your needs

- Deductibles are affordable for your budget

- Exclusions and limitations are clearly understood

- Renewal terms and potential rate increases

- Cancellation policies and any associated fees

State-by-State Bundle Savings Analysis (Auto and Renters Insurance Bundle)

| State | Average Bundle Cost | Average Separate Cost | Average Annual Savings | Bundle Discount % |

|---|---|---|---|---|

| California | $1,890 | $2,220 | $330 | 15% |

| Texas | $1,680 | $1,980 | $300 | 15% |

| Florida | $2,340 | $2,760 | $420 | 15% |

| New York | $2,160 | $2,520 | $360 | 14% |

| Pennsylvania | $1,560 | $1,830 | $270 | 15% |

| Illinois | $1,620 | $1,890 | $270 | 14% |

| Ohio | $1,380 | $1,620 | $240 | 15% |

| Georgia | $1,740 | $2,040 | $300 | 15% |

| North Carolina | $1,440 | $1,680 | $240 | 14% |

| Michigan | $2,520 | $2,940 | $420 | 14% |

Impotant

Note: Costs represent average full coverage auto insurance plus standard renters insurance

Common Mistakes to Avoid When Bundling Insurance

Mistake 1: Not Comparing Total Costs

Don’t assume bundling is automatically cheaper. Calculate total annual costs for bundled vs. separate policies from multiple providers.

Mistake 2: Over-Insuring or Under-Insuring

Accurately assess your needs. Don’t buy excessive coverage to maximize bundle discounts, but ensure adequate protection.

Mistake 3: Ignoring Coverage Quality for Price

The cheapest bundle isn’t always the best value. Consider coverage quality, customer service, and claims satisfaction alongside price.

Mistake 4: Forgetting to Update Coverage

Life changes (new car, valuable purchases, roommate changes) require policy updates. Review coverage annually and after major life events.

Mistake 5: Not Asking About All Available Discounts

Insurance companies won’t always advertise every discount. Proactively ask about all potential savings opportunities.

Mistake 6: Accepting the First Bundle Quote

Shop around with at least 5 insurers. Bundle discounts vary significantly, and loyalty to your current provider may cost hundreds annually.

Mistake 7: Overlooking Policy Exclusions

Read the fine print. Understanding what’s NOT covered prevents surprises during claims and helps you add necessary endorsements.

Auto and Renters Insurance Bundle FAQ

Digital Tools and Apps for Managing Bundled Insurance

Mobile App Features to Look For:

Policy Management: View and modify coverage, update information, add vehicles or properties digitally without agent calls.

Claims Filing: Report accidents, submit photos, track claim status, and communicate with adjusters through mobile interface.

ID Cards: Digital insurance cards accepted by law enforcement in most states, eliminating need for paper copies.

Payment Management: Schedule payments, view billing history, adjust payment methods, and receive payment reminders.

Roadside Assistance: Request towing, fuel delivery, lockout service, or tire changes directly through app with GPS location sharing.

Usage-Based Monitoring: Track driving habits, review scores, see potential discount impacts in real-time for telematics programs.

Virtual Assistant: AI-powered chatbots answer policy questions, provide quotes, and handle routine customer service needs 24/7.

Future of Auto and Renters Insurance Bundling

Emerging Trends

Usage-Based Insurance Integration: Pay-per-mile auto coverage combined with renters insurance creates dynamic pricing based on actual vehicle usage.

Smart Home Discounts: IoT devices (smart locks, leak detectors, security cameras) integrated with renters policies provide enhanced discounts and loss prevention.

On-Demand Coverage: Flexible policies allowing temporary coverage adjustments for seasonal vehicles or extended travel periods.

AI-Powered Underwriting: Machine learning algorithms provide more accurate risk assessment, potentially lowering premiums for low-risk customers.

Blockchain Claims Processing: Distributed ledger technology enabling faster, more transparent claims resolution with reduced fraud.

Climate-Adjusted Pricing: Geographical risk modeling for extreme weather events affecting both auto and property coverage costs.

Maximizing Your Bundle Value: Expert Tips

Tip 1: Maintain Continuous Coverage

Insurance gaps increase future premiums significantly. Maintain uninterrupted coverage even when switching providers to preserve low-risk status.

Tip 2: Increase Deductibles Strategically

Raising deductibles from $250 to $500 or $1,000 can reduce premiums 15-30% without significantly increasing out-of-pocket risk for most drivers.

Tip 3: Review Coverage After Major Purchases

Adding valuable items (jewelry, electronics, bikes) requires renters policy updates or scheduled item endorsements for full protection.

Tip 4: Take Advantage of Telematics

Usage-based insurance programs often provide 20-40% savings for safe drivers, stacking significantly with bundle discounts.

Tip 5: Leverage Life Changes for Better Rates

Marriage, home purchase, graduation, or career changes often trigger additional discounts. Notify your insurer immediately about qualifying life events.

Tip 6: Pay Annually If Financially Feasible

Monthly payment plans include administrative fees totaling 5-15% annually. Paying in full eliminates these charges plus qualifies for additional discounts.

Conclusion: Is Auto and Renters Insurance Bundling Right for You?

Bundling auto and renters insurance delivers substantial savings, simplified management, and enhanced coverage for most renters with vehicles. With average savings of $240-$600 annually and potential discounts up to 25%, bundling represents one of the easiest ways to reduce insurance costs without sacrificing protection.

The key to maximizing bundle value lies in thorough comparison shopping, understanding your coverage needs, leveraging all available discounts, and selecting an insurer that balances competitive pricing with exceptional service quality.

Take Action Today: Request quotes from at least 5 insurance providers, compare total bundled costs against separate policies, and don’t hesitate to negotiate or ask about additional discounts. The time invested in finding the optimal bundle can save you thousands over the life of your policies.

Remember that the best insurance bundle isn’t always the cheapest—it’s the one providing comprehensive protection, responsive customer service, and peace of mind at a price that fits your budget. Whether you choose State Farm’s extensive agent network, GEICO’s competitive pricing, Progressive’s digital tools, or any other top provider, bundling your auto and renters insurance represents a smart financial decision for most renters.

Additional Resources and Tools

Insurance Comparison Websites

- Insurance.com: Compare quotes from multiple providers simultaneously

- Policygenius: Independent agent platform with unbiased recommendations

- The Zebra: Comprehensive comparison tool with customer reviews

- NerdWallet Insurance: Educational resources with rate comparisons

- Insurify: AI-powered quote comparison with instant results

State Insurance Department Resources

Each state maintains an insurance department website offering:

- Required minimum coverage information

- Consumer complaint records for insurers

- Rate comparison tools

- Claims filing assistance

- Fraud reporting mechanisms

Professional Insurance Associations

- Independent Insurance Agents & Brokers of America (IIABA): Find local independent agents

- National Association of Professional Insurance Agents (PIA): Agent locator and consumer resources

- Insurance Information Institute (III): Educational materials and industry statistics

Bundle Insurance Checklist (Auto and Renters Insurance Bundle)

Before purchasing your auto and renters insurance bundle, ensure you’ve:

Bundle Insurance Checklist

Compared quotes from 5+ insurance companies

Verified all available discounts have been applied

Confirmed coverage limits meet your actual needs

Read and understood policy exclusions and limitations

Verified deductibles are affordable for your budget

Checked customer service ratings and reviews

Confirmed claims satisfaction scores

Reviewed mobile app functionality and features

Asked about potential rate increases at renewal

Verified cancellation policy and any associated fees

Confirmed billing cycle preferences (monthly vs. annual)

Saved digital copies of policy documents

Added insurance company contacts to your phone

Set calendar reminder for annual policy review

Understanding Your Bundle Insurance Policy Documents

Key Documents You’ll Receive

Declarations Page: Summary of your coverage including policy numbers, coverage limits, deductibles, premiums, and effective dates for both auto and renters policies.

Policy Contract: Complete terms and conditions, including what’s covered, excluded, and your rights and responsibilities as the policyholder.

Endorsements and Riders: Additional coverage modifications or special provisions added to your standard policy.

Proof of Insurance Cards: Digital and/or physical cards proving auto insurance coverage, required in most states when driving.

Billing Statements: Payment schedules, due dates, and account balance information for your bundled policies.

Important Policy Terms to Understand

| Term | Definition | Why It Matters |

|---|---|---|

| Premium | Amount paid for insurance coverage | Your total cost, usually paid monthly or annually |

| Deductible | Out-of-pocket amount before insurance pays | Higher deductibles = lower premiums, but more upfront cost |

| Coverage Limit | Maximum amount insurer will pay for claims | Ensures adequate protection for potential losses |

| Named Insured | Person(s) covered by the policy | Only named insureds receive full policy benefits |

| Peril | Specific cause of loss (fire, theft, collision) | Defines what events trigger coverage |

| Actual Cash Value | Item’s worth minus depreciation | Auto claims often use ACV for older vehicles |

| Replacement Cost | Cost to replace item with new equivalent | Renters insurance often offers RCV for belongings |

| Liability | Legal responsibility for damages to others | Critical protection against lawsuits |

| Subrogation | Insurer’s right to recover costs from at-fault party | May affect how claims are processed |

| Underinsured Motorist | Coverage when at-fault driver has insufficient insurance | Protects you from others’ inadequate coverage |

Real Customer Savings Examples

Example 1: College Graduate Bundle Success

Profile: Recent graduate, 24 years old, renting studio apartment in Austin, TX

- Vehicle: 2019 Honda Civic

- Previous Cost: Auto insurance $2,100/year (separate company) + Renters insurance $240/year = $2,340/year

- New Bundle: Progressive bundle at $1,989/year

- Annual Savings: $351 (15% discount)

- Additional Benefits: Snapshot program reduced rate further by $210 after 6 months

- Total First-Year Savings: $561

Example 2: Young Family Bundle Optimization

Profile: Married couple, 32 years old, renting house in Charlotte, NC

- Vehicles: 2021 Toyota RAV4 and 2018 Ford F-150

- Previous Cost: Auto insurance $3,200/year + Renters insurance $450/year = $3,650/year

- New Bundle: State Farm bundle at $3,103/year

- Annual Savings: $547 (15% discount)

- Additional Benefits: Stacking discounts (safe driver, multi-car, paid-in-full) reduced premium additional $285

- Total Annual Savings: $832

Example 3: Urban Professional Bundle Strategy

Profile: 28-year-old professional, renting apartment in downtown Seattle

- Vehicle: 2020 Mazda3

- Previous Cost: Auto insurance $1,800/year + Renters insurance $300/year = $2,100/year

- New Bundle: Allstate bundle at $1,785/year

- Annual Savings: $315 (15% discount)

- Additional Benefits: Drivewise app provided additional $252 annual savings

- Total Annual Savings: $567

Example 4: Military Family USAA Bundle

Profile: Military family, 35 years old, renting near base in Virginia Beach

- Vehicles: 2022 Jeep Wrangler and 2019 Honda Accord

- Previous Cost: Auto insurance $2,800/year + Renters insurance $350/year = $3,150/year

- New Bundle: USAA bundle at $2,520/year

- Annual Savings: $630 (20% discount)

- Additional Benefits: Deployment discounts and military-specific coverage

- Total Annual Savings: $630

Insurance Bundle Tax Implications

Is Insurance Tax-Deductible?

Personal Auto and Renters Insurance: Generally NOT tax-deductible for personal use vehicles and rental properties.

Exceptions for Deductibility:

- Business Use: If you use your vehicle for business purposes, a portion of auto insurance may be deductible as a business expense

- Home Office: If you have a legitimate home office in your rental, some renters insurance may qualify for home office deduction

- Casualty Losses: Uninsured losses from theft or damage may be deductible if they exceed 10% of adjusted gross income in federally declared disaster areas

Consult a Tax Professional: Tax laws vary by state and individual circumstances. Always consult a qualified tax advisor for personalized guidance.

Impact of Life Changes on Your Bundle

Major Life Events Requiring Policy Updates

| Life Event | Auto Insurance Impact | Renters Insurance Impact | Action Required |

|---|---|---|---|

| Marriage | Add spouse, potential discount | Add spouse, combine coverage | Update named insureds within 30 days |

| Having Children | Minor impact on auto rates | May increase liability needs | Consider umbrella policy |

| Buying a Home | May need separate homeowners | Cancel renters, consider bundling homeowners | Notify insurer before closing |

| Divorce | Remove ex-spouse, separate policies | Update named insured | Provide legal documentation |

| Job Change | Update commute distance | May affect rates if relocating | Notify within 30 days |

| Moving | Update garaging address | Update rental address, adjust coverage | Notify before or immediately after move |

| Buying New Car | Update vehicle, adjust coverage | No direct impact | Add vehicle within 30 days |

| Roommate Change | May affect renters policy | Update occupants, adjust liability | Update immediately |

| Valuable Purchases | No impact unless vehicle accessories | Schedule high-value items | Add riders for items over $1,500 |

| Retirement | Lower mileage may reduce rates | Minimal impact | Request mileage-based discount |

Environmental and Weather Considerations

Climate Risk Factors Affecting Bundle Pricing

High-Risk Weather Zones:

- Hurricane-Prone Areas: Florida, Gulf Coast, Atlantic seaboard see 20-50% higher renters insurance costs

- Tornado Alley: Oklahoma, Kansas, Texas experience elevated property damage risks

- Wildfire Zones: California, Colorado, Western states face increasing fire risk premiums

- Flood Zones: Coastal and river valley areas require separate flood insurance (not included in standard bundles)

- Hail Risk Areas: Plains states experience frequent hail damage affecting auto comprehensive coverage

Climate Change Impact: Insurance companies increasingly factor climate risk into pricing models, with premiums in high-risk areas rising 5-15% annually above inflation.

Bundle Insurance for Special Situations

International Students Renting in USA

Unique Considerations:

- May lack U.S. credit history, affecting rates

- Limited driving history requires verification from home country

- Visa status doesn’t affect eligibility with most insurers

- Consider international driver’s license acceptance

Best Options: Progressive, GEICO, and State Farm offer competitive rates for international students with limited U.S. history.

Military Personnel and Veterans

Special Benefits:

- USAA offers exclusive military-focused coverage

- Deployment discounts reduce or suspend coverage during overseas service

- Worldwide coverage for personal property

- Flexible policy modifications for frequent relocations

Best Options: USAA (best rates and service), GEICO (military discounts), Armed Forces Insurance

Senior Renters (55+)

Considerations:

- Mature driver discounts available from most insurers

- Reduced annual mileage often qualifies for additional savings

- Some insurers offer enhanced coverage for medical expenses

- Fixed income requires budget-conscious coverage selection

Best Options: State Farm, Nationwide, and Allstate offer competitive senior discounts and enhanced benefits.

High-Risk Drivers

Challenges:

- DUI convictions increase auto rates 50-200%

- Multiple accidents or violations limit insurer options

- May require SR-22 or FR-44 financial responsibility filing

- Bundle discounts may be limited or unavailable

Best Options: Progressive, The General, and Dairyland specialize in high-risk driver coverage.

Technology Integration in Modern Bundle Insurance

Telematics Programs Comparison

| Program Name | Insurance Company | Discount Potential | Monitoring Method | Privacy Level |

|---|---|---|---|---|

| Snapshot | Progressive | Up to 30% | Plug-in device or app | Moderate – tracks speed, braking, time of day |

| Drivewise | Allstate | Up to 40% | Mobile app | Moderate – tracks acceleration, braking, speed |

| SmartRide | Nationwide | Up to 40% | Plug-in device | Limited – tracks mileage, hard braking |

| Drive Safe & Save | State Farm | Up to 30% | Mobile app or device | Moderate – tracks mileage and driving behaviors |

| RightTrack | Liberty Mutual | Up to 30% | Mobile app | Moderate – tracks acceleration, braking, cornering |

| IntelliDrive | Travelers | Up to 30% | Mobile app or device | Moderate – tracks time, speed, braking |

Smart Home Integration for Renters

Connected Device Discounts:

- Smart Smoke Detectors: Nest Protect, First Alert – 5-10% discount

- Water Leak Sensors: Flo by Moen, Phyn – 5-15% discount

- Security Systems: Ring, SimpliSafe, ADT – 10-20% discount

- Smart Locks: August, Schlage Encode – 5-10% discount

- Security Cameras: Arlo, Nest Cam – 5-10% discount

Requirements: Most insurers require professional installation or certification for smart device discounts.

Final Recommendations: Choosing Your Perfect Bundle

For Budget-Conscious Renters:

Top Choice: GEICO or Progressive

- Competitive base rates

- Transparent pricing tools

- Solid bundle discounts

- Efficient online management

For Service-Oriented Customers:

Top Choice: State Farm or Allstate

- Extensive agent networks

- Personalized service

- Comprehensive coverage options

- Strong customer satisfaction ratings

For Tech-Savvy Users:

Top Choice: Progressive or Root

- Advanced mobile apps

- Usage-based insurance programs

- Digital-first experience

- Innovative coverage options

For Military Families:

Top Choice: USAA (if eligible)

- Unmatched military-specific benefits

- Exceptional customer service

- Deployment accommodations

- Worldwide coverage

For High-Value Protection:

Top Choice: Farmers or Liberty Mutual

- Scheduled property coverage

- Enhanced replacement options

- Customizable high limits

- Comprehensive loss protection

Start Saving Today: Your Next Steps

- Create Your Coverage Profile: Document your vehicle details, rental property information, and valuable possessions

- Request Multiple Quotes: Contact 5-7 insurers for comprehensive bundle comparisons

- Calculate Total Costs: Compare annual bundled costs against separate policy totals

- Verify All Discounts: Ensure every eligible discount is applied to your quote

- Read Policy Details: Review coverage terms, exclusions, and limitations carefully

- Make an Informed Decision: Select the bundle offering optimal value, coverage, and service

- Schedule Annual Reviews: Set calendar reminders to reassess your bundle every 12 months

Your insurance bundle should work as hard as you do. By following this comprehensive guide, you’re equipped to find the perfect auto and renters insurance bundle that protects your assets, fits your budget, and provides peace of mind for years to come.

Car and Renters Insurance Bundle

Last Updated: October 2025 | Prices and discounts subject to change. Always verify current rates with insurance providers.